Welcome to the 1st Edition of our new Monthly LinkedIn Newsletter—The Diamond Pulse. Each month, you can expect to receive exciting updates on diamond, gem and jewelry market trends and actionable insights that will help you make informed decisions for your business.

THE MONTHLY 'RAP': Will Early Market Trends Persist Throughout 2025?

The start of the year brought negative and positive trends for the industry. The downturn in China’s luxury segment continued, with Hong Kong jeweler Luk Fook minimizing diamond offerings and Chow Tai Fook noting consumers opted to buy jewelry abroad. Sluggish rough demand persisted, as Petra reduced its rough-pricing forecast and Mountain Province reported weak rough prices. Amid socioeconomic and demand challenges, violence has been erupting. Security forces shot and killed two individuals at Gemfields’ ruby mine during an attempted break-in. A kidnapping and robbery plot against a Florida jeweler and the death of two in an armed heist at the premises of Namdia, a Namibia government-owned trading company, have also underscored a trend of emerging hostility.

However, the industry also noted positive movement, including a rebound in retail over the holiday season. US jewelry sales grew, while overall retail sales increased 3.8% year on year, according to Mastercard. Similarly, Visa reported a year-on-year uptick of 5% in the clothing and accessories segment, which includes jewelry. The season saw record growth, verging on pre-pandemic levels, data from the National Retail Federation (NRF) showed. Meanwhile, jewelry shows, including Vicenzaoro and IIJS Signature, have seen a spike in attendance and demand, while the debut of new shows, such as the Doha International Diamond & Gem Conference, signals confidence in the trade.

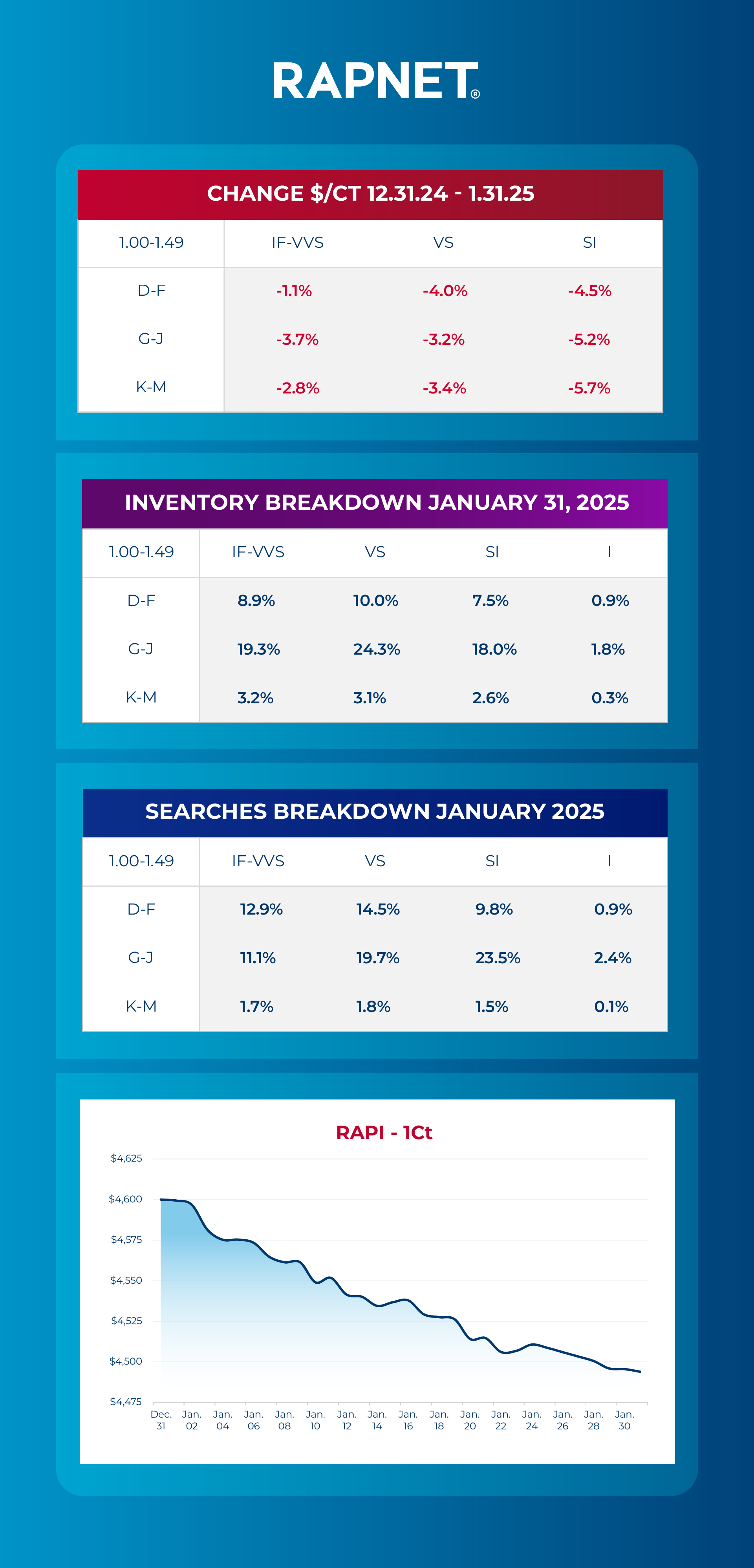

Here's your diamond market analysis from RapNet for January 2025

In January, diamond prices fell, with the 1ct RAPI dropping 2.3% as the market slowed following the holiday season and uncertainty set in for 2025. While prices fell across the board, higher-quality diamonds retained their value more than lower-quality round 1-carat diamonds. At the end of January, nearly a quarter of all round 1-carat diamond inventory on RapNet was for G-J, VSs while nearly a quarter of the searches on RapNet throughout January were for G-J SIs. The discrepancy between inventory breakdown and searches breakdown may represent an imbalance between supply and demand in the market.

Join the industry's largest and most trusted diamond, gem and jewelry trading network.

Back to Newsletters

Back to Newsletters

![Diamonds 6[1][1]](/media/2120/diamonds-6-1-1.png)